The Ultimate Guide To Paul B Insurance Medicare Supplement Agent Huntington

Wiki Article

Get This Report on Paul B Insurance Medicare Agent Huntington

Table of ContentsEverything about Paul B Insurance Medicare Agent HuntingtonThe Only Guide for Paul B Insurance Medicare Part D HuntingtonThe 30-Second Trick For Paul B Insurance Medicare Insurance Program HuntingtonLittle Known Facts About Paul B Insurance Insurance Agent For Medicare Huntington.The Ultimate Guide To Paul B Insurance Medicare Supplement Agent Huntington

(People with certain specials needs or health conditions may be eligible prior to they transform 65.) It's designed to shield the health and wellness as well as well-being of those that utilize it. The 4 components of Medicare With Medicare, it is necessary to understand Parts A, B, C, as well as D each part covers particular services, from medical care to prescription drugs.

If you're currently obtaining Social Security benefits, you'll automatically be registered partially An as quickly as you're qualified. Discover when to register in Medicare. You can obtain Component A at no expense if you or your spouse paid right into Medicare for at the very least 10 years (or 40 quarters).

What Does Paul B Insurance Medicare Advantage Agent Huntington Mean?

Medicare Benefit is an all-in-one plan that packages Initial Medicare (Component An and Component B) with additional advantages. Kaiser Permanente Medicare health insurance are examples of Medicare Benefit plans. Bear in mind that you require to be signed up partly B and eligible for Component A before you can enroll in a Medicare Benefit strategy.

Before we talk concerning what to ask, allow's talk about who to ask. There are a whole lot of means to register for Medicare or to get the information you need prior to picking a strategy. For lots of, their Medicare trip begins directly with , the official web site run by The Centers for Medicare as well as Medicaid Providers.

Paul B Insurance Insurance Agent For Medicare Huntington Things To Know Before You Get This

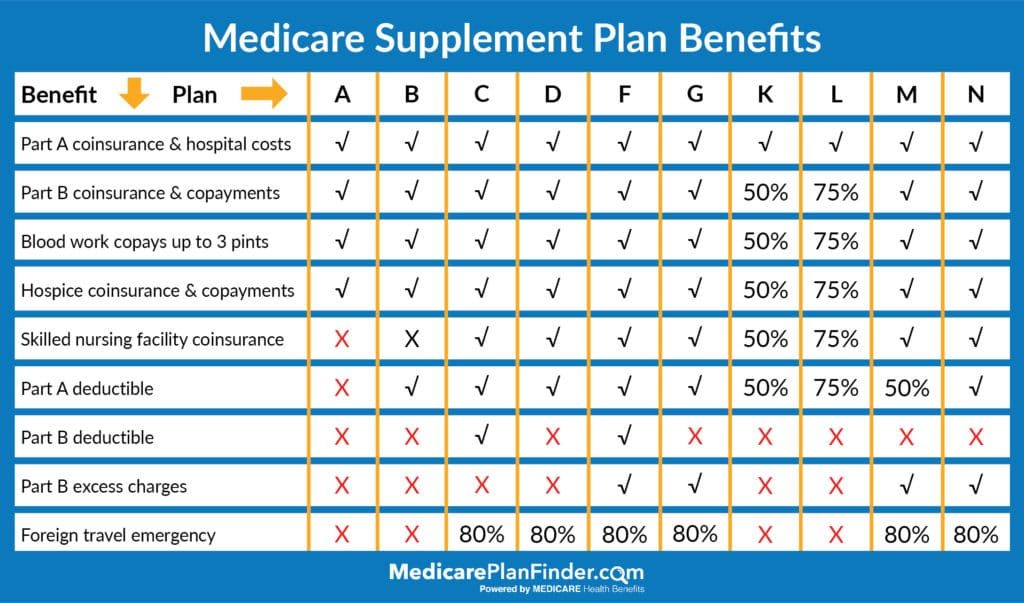

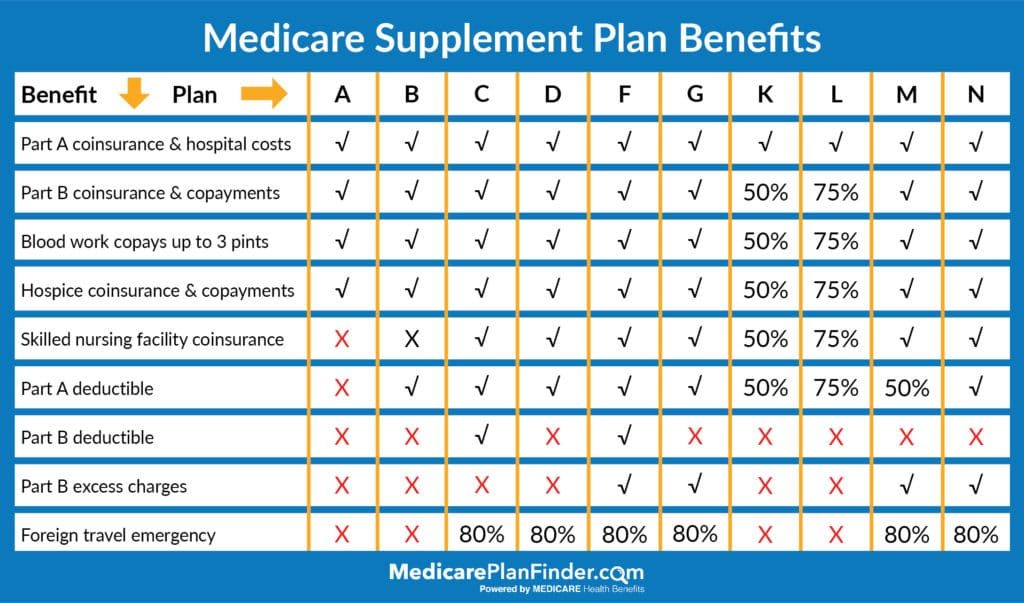

It covers Part A (hospital insurance coverage) as well as Component B (medical insurance). This includes things that are thought about clinically necessary, such as health center remains, regular physician gos to, outpatient services and more. is Medicare protection that can be acquired directly from a personal healthcare firm. These plans function as an alternative to Original Medicare, integrating the protection alternatives of Components An and also B, as well as fringe benefits such as oral, vision and also prescription drug coverage (Component D).Medicare Supplement plans are a wonderful enhancement for those with Initial Medicare, aiding you cover expenditures like deductibles, coinsurance and also copays. After obtaining treatment, a Medicare Supplement strategy will certainly pay its share of what Original Medicare really did not cover then you'll be accountable for whatever stays. Medicare Supplement prepares generally do not consist of prescription medication protection.

You can enroll in a separate Part D plan to add medication protection to Original Medicare, a Medicare Expense plan or a few other kinds of strategies. For several, this is frequently the very first concern thought about when looking for a Medicare strategy. The cost of Medicare varies depending upon your healthcare demands, financial support qualification and just how you pick to obtain your benefits.

How Paul B Insurance Local Medicare Agent Huntington can Save You Time, Stress, and Money.

For others like seeing the medical professional for a sticking around sinus infection or loading a prescription for protected prescription antibiotics you'll pay a charge. The quantity you pay will be various depending on the sort of strategy you have as well as whether or not you have actually looked after your deductible. Medicine is an integral part of take care of many individuals, especially those over the get more age of 65., as well as insurance coverage while you're traveling domestically. If you intend on taking a trip, make sure to ask your Medicare expert concerning what is as well as isn't covered. Possibly you have actually been with your existing physician for a while, as well as you desire to keep seeing them.

Lots of people who make the button to Medicare continue seeing their regular doctor, but also for some, it's not that basic. If you're working with a equitable life Medicare expert, you can inquire if your medical professional will remain in network with your brand-new strategy. If you're looking at plans separately, you might have to click some links as well as make some phone calls.

Some Known Factual Statements About Paul B Insurance Insurance Agent For Medicare Huntington

gov site to look up your existing medical professional or one more service provider, facility or medical facility you wish to use. For Medicare Advantage plans and also Cost plans, you can use this link call the insurance provider to make sure the physicians you intend to see are covered by the strategy you're interested in. You can likewise inspect the plan's site to see if they have an online search tool to find a protected medical professional or facility.Which Medicare strategy should you go with? That's the ideal part you have alternatives. And eventually, the option is up to you. Keep in mind, when beginning, it is essential to see to it you're as notified as possible. Begin with a list of considerations, ensure you're asking the right inquiries and start concentrating on what kind of strategy will best offer you and your requirements.

Medicare Advantage plans are personal insurance coverage that aid with the gaps in Medicare coverage. Although they seem comparable to Medigap strategies, don't confuse both, as they have some remarkable differences. To be qualified for Medicare Advantage registration, you should initially sign up for Original Medicare (Medicare Component An as well as Part B).

Report this wiki page